Think about it, much of our merchandise is occasionally purchased or lost. But some items just seem to fly out of the store.

Recent research in the United States and the United Kingdom indicates less than 20 percent of a store’s products account for more than 80 percent of its inventory losses. This makes sense since most things are not randomly distributed, but rather are clustered for a reason (things like gas stations, which tend to be next to busy street intersections, for example). Likewise, certain products go missing more than others because of one or more of the following reasons:

- Their popularity,

- Their liquidity or ease of conversion to cash,

- Their size and portability, and

- Their relative vulnerability in the supply chain and store.

Because of this clustering of loss into fairly few items, even within a category or brand, for instance only certain razor blades or specifically branded and sized shirts, our protection efforts can be very focused.

Just as losses are clustered in very few items, they can also be concentrated in very few stores, or even in certain seasons and time periods.

We also know from empirical research, as well as routine observation, that certain managers are better than others, which helps drive loss levels.

Finally, a relatively small percentage of active offenders are high-impact.

It’s Not All about Theft

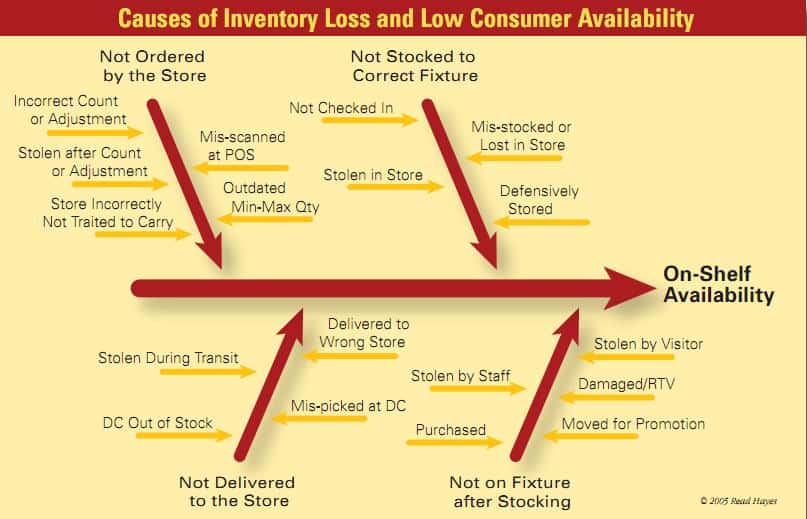

Although national studies of perceptions on inventory shrinkage indicate the causes of loss are driven mostly by shoplifting and employee theft, every chain and store is different. In some stores and with some products, the loss problem may be more a function of poor procedures and/or execution, exacerbated by high volume, physically small items that may be readily lost or misplaced throughout the supply chain.

Remember, we aren’t here to just protect stores; we’re here to help protect people and our entire enterprise. To help you more precisely focus your asset protection efforts, you need a process—a hot products process. This process should be customized to your store and product mix, and to your unique culture and personnel. Following is a sample process for identifying and handling inventory losses.

The Hot Stuff Process

The first step in this process is to thoroughly diagnose your problem. After determining which products are creating your biggest, most costly problems via ship-to-scan ratios, adjustments, and counts, you should strive to identify the prime causes of the loss for those items, which could include flawed processes, rampant apathy and errors, or internal or external theft.

Video cameras, staff and shoplifter interviews, incident data, cycle counts, and supply-chain and store-process mapping can all help you discover why certain products are hot. Don’t assume you know; you need to check it out.

Next, you should look to see if the problems are chain wide or isolated in certain locations. Based on what you find, you can look to the following menu and select those actions to test and refine what might work best on your problems.

Secure Product Packing and Shipping. Hot or high-risk products have been identified as the company’s top loss items, and they should be handled accordingly. Very hot products in the distribution center should be kept segregated in secure areas. Whenever possible, these items should be separated from other products, and secured in special containers for shipping. This process inhibits theft and inspires careful handling, while making item disappearance more obvious.

Item picking should be monitored. Non-clear shrink-wrap should be used when possible to hide the presence of desirable hot items while hindering access.

Randomly selected and/or high loss stores should be tested quarterly for shipment integrity by “salting” shipments with item counts that are lower or higher than stated on the invoice or computer.

In-Store Product Champion. A department manager or other long-term, responsible employee in DCs and stores should receive special training on handling and counting their hot products. The champion, and a backup champion, are given responsibility for maintaining the sales and security of the high-risk products. Another member of management should check the diligence and accuracy of the champion’s efforts monthly.

Secure Delivery, Fast-Track Movement, and Secure Storage. The product champion should arrange for and help supervise secure item delivery into their store. The receiving area can be chaotic, where hot products can be left unattended, boosting the probability of their loss, damage, or theft. Although very difficult in the real world, hot products should be carefully counted and recounted upon delivery whenever possible. All discrepancies should be reported immediately.

The receiving area and all back doors should be secured with rollup doors kept locked with sliding locks, except during supervised deliveries.

Area access should be strictly limited and documented via exception reporting.

All trash and compacted carton removal should be supervised.

No parking should be allowed near back doors or dumpsters, which may be kept locked.

Receiving and rear exterior store areas should be under CCTV and access control surveillance.

Delivery drivers should be kept under close observation.

As soon as hot products are delivered, they should be quickly and securely moved (fast tracked) to the sales display, during daytime hours when possible, or put into a secure storage area. Special transport carts can be used for some products.

All damaged hot products should be verified as such by a supervisor, and return-to-vendor (RTV) areas should be secured, with limited access, and checked monthly by store management.

RTV and disposal processes should be audited regularly.

Item Display and Location. Usually hot products can be kept on open sale in many or most stores to accommodate customer selection if the display area is clearly visible within five to twenty feet of a regular employee workstation. Obvious, smoked-glass CCTV domes can be considered for positioning to monitor the display itself, and any surrounding areas where offenders might go to attack packaging and conceal hot products prior to their theft.

Recent data from our studies indicates the display location influences offenders since the more angles and directions they must check to see if they are being observed, as well as the obviousness of missing items, can affect their decision making. Noise, lighting, and other variables can also affect offenders.

Display Fixtures. In some cases and in some stores, professional thieves steal large quantities of a hot product for conversion to cash. Special display fixtures are available that have pegs or spring feeds that hinder high-rate item selection. Requiring two-hand selection can also add risk into the equation for thieves. Signage that mentions electronic monitoring of the items may also be placed on hot products displays in these stores.

Product Replenishment. There should be enough items on displays to satisfy customers, for example, optimal levels might be two weeks, but excess product can be misplaced or stolen without the champion noticing. In some cases, secure item staging areas or drawers can be provided with combination locks. Combinations should be changed at least bi-annually.

Staff Awareness and Development. Employees are key to all retailing. All employees that work with hot products can be provided an activity checklist for those products with a sign off for the employee and supervisor. Staff should be trained to provide active customer service, keep displays orderly, remain aware of missing items and where they might be found elsewhere in the store, and how to spot, service, and report possible offenders in their assigned and defined work area (zoning). Discarded packaging or intact items should be recorded, and findings plotted on a store map to locate item drop off or theft concealment areas. This allows for search and surveillance planning.

Regular Product Counting. Weekly or even daily counting of hot products raises staff awareness, helps locate missing product, maintains on-shelf availability and presentation quality, and reduces theft. The product champion should monitor item counting, on-hand quantity adjustments, and problem plotting and reporting. Empirical research indicates regular counting of high-risk products reduces loss levels.

Situational Action. EAS tagging somehow visibly advertised, merchandise alarms, plastic safer cases, attack-resistant packaging, distinctive item marking with contact data, cabling, secure fixtures, store protection specialists, and other innovations can be tested and employed for high-theft items in high-theft locations.

It is vitally important that tagging and other protective efforts be carefully thought out after a full problem diagnosis, and that rigorous testing and refinement be done before full-scale deployment. Our research and others shows very mixed results of many LP practices. Efficacy and cost-effectiveness are a function of precise usage, proper design, and long-term, consistent execution. None of these variables is easy, but must be taken into account.

Decision-Making Data. Data are important, and accurate data are hard to find, but mission critical. Asset protection decision makers must have a fairly accurate picture of the who, what, when, where, why, and how of loss to make an impact. Shrink data are notoriously inaccurate. Item adjustments, discarded packaging and EAS tags, and other methods are helpful for maintaining on-shelf availability, but provide more detail of how compliant staff is in recording these things than a reflection of actual loss, and do not generally tell us what might have happened to missing stuff. A first order of business for retailers is generating accurate data.

And data play a major role in focusing efforts on the real problems. It was mentioned at the beginning of this article that much loss is not theft related. Much is, but process failure shrink masks theft-related problems.

A major British retailer has found tens of millions in manageable shrinkage coming from inventory handling and pricing problems rather than theft. Product pricing files should be audited and kept up to date. Be wary of using multiple SKUs for the same item for promotions, check pricing errors in stores, and be aware of how mis-scanning due to errors, packaging problems, and fraud can skew shrinkage. Scrutinize your supply-chain and data-stream processes for loss reduction opportunities.

Partner Up. Nobody can affect shrinkage alone. Loss prevention or asset protection departments can only provide expertise, leadership, and limited resources. Company leaders, logistics and support departments, and store managers are the most able to reduce losses.

Hot product suppliers should meet at least bi-annually with the retailer to discuss hot products analysis, and recommended action plans. Many parts of the hot product process may be in part supported by this partnership. The partnership can also consider mutual legislative and taskforce support in high organized retail theft areas.

Ongoing joint testing of innovative protection procedures and technologies should become part of the hot products partnership process. Packaging materials, sizing, and marking might help reduce some theft. Likewise, shipping cartons, inner packs, signage, displays, planograms, display locations, barcoding,

RFID, handling processes, and even promotional items, techniques, and displays can be engineered to increase efficiency and accuracy while reducing error and opportunities for theft.

Get Focused and Make It Happen

Use your data, your expertise and experience, and your intuition to create a strategy, and then use your leadership to generate the execution you need to reduce high-risk product loss.

We firmly believe evidence-based loss prevention will eventually supplement or even replace current practices (see Evidence-Based LP on page 38). Growing numbers of retailers and their supplier partners are using the evidence-based process to shape loss prevention (see Industry Loss Reduction Team page 46). Anecdotes, expert opinions, and benchmarking have their place, but theory-informed, empirical research provides retailers with more credible evidence of why something is happening, how best to address the issue, and a systematic method to test and refine LP efforts so they provide the efficacy and quantifiable cost-effectiveness senior executives demand. Life safety, company reputation, liability, and profit needs require rigorous methods be used.

Industry Loss Reduction Team

The Industry Loss Reduction Team (ILRT) is a partnership of leading retailers, product suppliers, and researchers using systematic research and development to sell more and lose less.

Established by several large retailers, including CVS/pharmacy, Walgreen’s, Wal-Mart, Kmart, and Food Lion, the ILRT’s original mission was to work with high-risk product suppliers to EAS source-tag select products. The group has since expanded in both membership and mission.

The team is now committed to working closely with product suppliers and protective system providers, such as Gillette, GlaxoSmithKline, Pfizer, Wyeth, Schering Plough, Mead Johnson, and Ross Abbott, to jointly develop and rigorously test more effective asset protection processes.

The Loss Prevention Research Council has been selected to facilitate the ILRT’s administration, meetings, and research activities, in short to provide skilled, credible research and development (R&D) services to world-class organizations.

Our Activities

Our R&D focus is to better understand the causes and dynamics of supply-chain and in-store losses, in order to develop and refine practical, cost-effective solutions. To this end, the group meets and communicates regularly to identify high-loss items, locations and times, as well as a relevant high-impact R&D agenda. ILRT is free and open to interested parties, and all R&D projects are approved and funded by the members.

Current R&D efforts include providing in-depth loss profiles for over 200 very high-loss items, collecting relevant research literature and case studies on seemingly successful asset protection efforts, developing an initial draft high-risk products (HRP) protection template of best practices for guarding HRP items throughout the supply chain and in the store. This template will be filled out and validated via an ongoing field research agenda. An initial project involves improving secondary location display sales and loss performance with select products.

Our research and development efforts include external benchmarking surveys, focus groups, surveys and interviews of offenders, consumers, field staff, and experts, rigorous field experiments, video analyses, and quantitative modeling, to test hypotheses and produce actionable reports.

Future WorkThe ILRT plans to continue adding interested, progressive product suppliers, retailers, and solutions providers to the program in order to broaden the team’s resources and impact. For more information about becoming involved with the ILRT, visit the LPRC website at www.lpresearch.org or contact Dr. Hayes at rhayes (at) lpresearch (dot) org.

CVS/pharmacy is one of the founding members and current chair of the Industry Loss Reduction Team (ILRT). Their loss prevention department has been proactive in analyzing the hot products targeted in their 5,000-plus stores and testing and implementing new loss prevention strategies.

In the March/April 2004 issue of LossPrevention, an article entitled “Product Protection—Beyond EAS” described the process of how CVS examined this issue and some of the successes they realized. The article is available in the archives section of the magazine web site at www.LPportal.com.

In the year since that article, CVS has continued to move forward on the production protection front. “Our involvement with the ILRT continues to reap benefits for us,” says Jon H. Roberts, product protection manager. “By partnering with our external solutions providers as well as our internal product managers, we have found new and improved ways of reducing losses and increasing sales in our high-risk categories.”