In today’s constantly changing retail landscape of omni-channel and omni-commerce consumer buying, another aspect of retail that continues to evolve is organized retail crime (ORC). The ORC phenomenon has become even more organized, and the thefts and frauds committed have become more complex and lucrative. With the changes in our retail landscape, ORC must be recognized for its evolution over the years. Here is a list of the top ten most important ORC issues and concerns in today’s world.

1. Update the ORC Definition

The current definition of ORC does not apply in today’s sophisticated retail landscape or to the types of ORC crimes that have propagated since the definition’s origin. A current general ORC definition compiled from various sources is as follows:

Organized retail crime involves the association of two or more persons engaged in illegally obtaining retail merchandise in substantial quantities through both theft and fraud as part of an unlawful commercial enterprise. The primary objective of these professional crime rings is to steal from retail organizations for the purpose of turning retail products into financial gain, rather than for personal use. Typically coordinated under well-planned procedures and rules, organized retail crime can operate on a local, regional, national, or international scale. These intricate criminal operations are responsible for tens of billions of dollars in losses each year that can devastate a retail business.

Here is a proposed new ORC definition:

Organized retail crime is any organized criminal, conspiratorial attack on the retail establishment. ORC involves the association of two or more persons engaged in illegally or fraudulently obtaining retail merchandise, tender, confidential data, and customer personally identifiable information for the sole purpose of converting it into criminal financial gain. Typically coordinated under well-planned procedures, rules, and technical expertise, organized retail crime can operate on a local, regional, national, and/or international scale. These intricate and highly technical criminal operations are responsible for hundreds of billions of dollars in global losses each year.

It would be helpful if the retail industry could agree on a concise, acceptable definition that accurately describes ORC today. You can contribute to developing a definition by taking this short survey.

2. Current Types of ORC Crimes

Organized and conspiratorial criminal entities attack retail far beyond the traditional physical theft of goods and subsequent criminal fence of these goods for a profit. ORC groups that attack retail have evolved into the following crimes:

- Sophisticated fraud schemes

- Deep supply chain theft

- Identity theft

- Complex return frauds

- Money-laundering operations

- Creative con games

- Cyber frauds

- Near-perfect counterfeiting

In addition, ORC bosses commonly hire programmers, hackers, and mathematicians to infiltrate a company’s cyber infrastructure to identify account algorithms in order to launch cyber point-of-sale attacks, web application and e-commerce attacks, insider threats, and well-choreographed attacks against a retailer’s databases and proprietary operating systems.

3. ORC and Criminal Reform

The introduction of criminal reform by state has obviously impacted the proliferation of ORC on the retail establishment. Criminal reform in any context fuels the “low-risk, high-reward crime” concept. Some organized criminal enterprises, gangs, mafias, and syndicates that traditionally monetized their efforts with violent and drug-related income have now converted their criminal operations to attack retail based on the low-risk, high-reward thought process. Combine criminal reform by state with federal law enforcement investigation thresholds, and you have even more flexibility for ORC groups if they operate in multiple states. ORC groups know that operating in criminal-reform states equals less pain inflicted by local law enforcement, and if they move from state to state and stay under the federal investigations thresholds, they are significantly immune from painful high-dollar federal prosecution.

4. Employee/ORC Collusion

ORC groups openly and actively recruit retail and financial company employees to be active components of their conspiracies. Primarily done via social media or in-person, these complicit employees are offered sums of money to process fraudulent transactions, overlook theft, or participate in actual thefts. Financial institutions and credit facilities are recruited similarly for customer account information, personal pedigrees, or to systematically approve suspicious transactions. Recent trends over the last few years have been recruitment of in-store asset protection personnel to engage in theft and overnight burglaries.

5. Brand Integrity

Customers observe theft in stores to the same extent employees do. Large-scale theft hits are both shocking and scary when customers observe the incident live instead of on the local news. This creates a brand integrity concern because customers should have a feeling of safety in a retail environment. The brand is also at risk when fraud is conducted using customers’ credit cards or stolen identities. Retailers are encouraged to study this within their own environments by simply measuring customer purchase patterns before and after fraud to determine sales lost due to negative brand experience. Some confidential retail feedback shows 60 to 80 percent lost customer credit sales after fraud incidents.

6. National ORC Database

Currently, forty-seven regional organized retail crime associations (ORCAs) operate across the nation, and each regional ORCA maintains an intelligence information database. These individual databases are disparate and patchworked with no centralized or master file. Any smart ORC group knows to cross state lines in retail thefts and frauds, with many operating nationwide. The need is long overdue for high-level data from each regional ORCA to feed into one master database. Retailer and law enforcement ability to research ORC theft and fraud activity on a national level, with access to detailed information at the ORCA level, would allow expedient inquiries and larger case values for federal prosecution. To see a comprehensive list of ORCAs, please click here.

7. ORC Violence

Surveys by the National Retail Federation (NRF) reflect an industry consensus among retailers that in-store violence has grown, and it’s an issue that retailers need to confront, suggested Robert Moraca, NRF’s vice president for loss prevention in a May 2019 LP Magazine article titled “Tools and Training Help LP Teams Punch Back Against Violence.” Moraca explained, “We’ve always told our people to not resist, so no one gets injured, but how does that fit today’s more violent ORC criminals? There is a level of violence that we’ve never really seen before, and it’s not just active shooter and active assailant, but just more aggression in general.”

Industry statistics on violent crimes and retail fatalities continue to increase. This increased violence has negative employee sentiment and increased workers’ compensation claims for AP teams. Many AP teams nationwide have seen dramatic increases in terroristic threats from ORC operating in their physical stores. Many of these terroristic threats come from states with significant criminal reform, such as California.

8. Retailers Owning Their ORC Problem

As retailers, we depend heavily on industry trade associations like the NRF and the Retail Industry Leaders Association (RILA), as well as each state merchant association, to help lobby state and federal government on issues that impact retailers. However, that dependence needs to be shared equally within each major retailer government relations teams. Often, we see that the issues of crime are not on the agenda of the government teams within major corporations. The importance of corporation lobbying efforts on state ORC legislation, criminal reform, and felony thresholds needs to be a top priority of corporate teams and not overly dependent on trade associations to be properly represented on these important legislative action items.

9. Cost of ORC

Over the last several years, ORC has been reported to cost retail an estimated $30 billion per year. That amount has been used but never adequately sourced. Knowing the vast opportunities for different types of ORC crimes, that figure is a low estimate that has not helped to get the attention of government legislators to understand the massive impact the ORC phenomenon has on the economy.

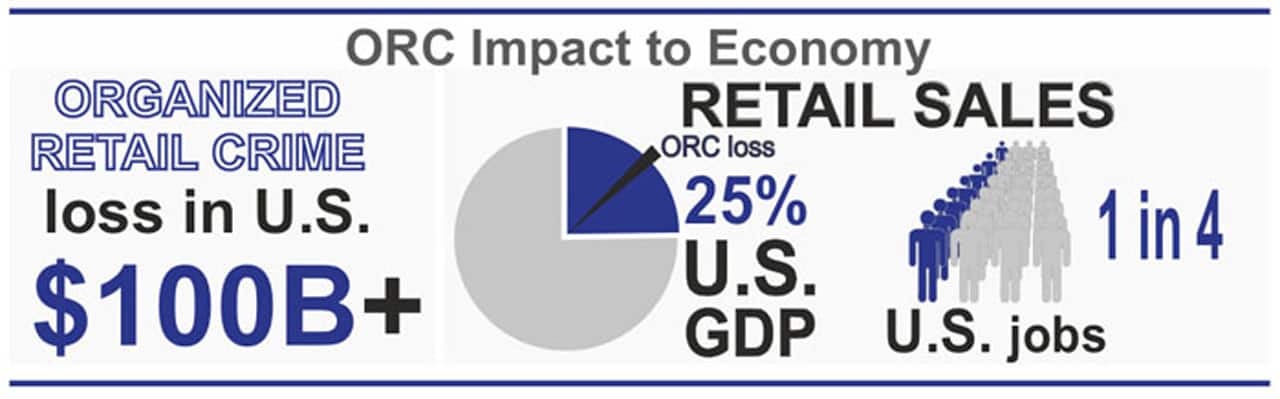

To understand the real ORC dollar impact, an estimate must be based on more than retail loss in the form of shortage, fraud loss, cash loss, bad debt, and margin loss. You must also include the financial industry’s losses, including those from financial and e-commerce frauds, identity theft, and other nonretail crimes. Adding all these factors leads us to a good, common-sense estimate of ORC loss at a minimum of $100 billion per year. On top of that, consider this scary question: how many small and local retail operations closed their doors or declared bankruptcy due to ORC and don’t even realize it?

10. The Perfect Storm

Just like a perfect storm in weather patterns, the variable impact of all the issue above can come together at just the right time at just the right strength to create a perfect storm for retail. Let’s dig a little deeper and look at what drives the United States economy. Retail in the US represents 25 percent of the annual gross domestic product (GDP) and accounts for 25 percent of available jobs. When you look at what is fueling ORC, you must include the impact of criminal reform, added types of ORC crimes, and ORC proliferation, the minimum estimate of $100 billion annual losses is a more logical representation of retail loss to ORC.

In fact, putting an ORC dollar loss to just the United States is ambiguous considering global e-commerce sales and fraud. The retail community faces a perfect storm—the combination of sophisticated ORC enterprises operating nationally and globally, states adopting criminal law reform, retailers downsizing talented ORC teams and reducing store staff to maintain liquidity, bad actors offering dark web services, and legislators responding slowly to ORC issues leading to an absence of coordinated and effective international response. Yet in this storm, we also have an opportunity by recognizing these ten ORC issues and acting on them quickly to neutralize the storm and slow down ORC proliferation.

Support for Complex ORC Fraud Investigations

In 1968, a small group of law enforcement officers and special agents of the credit card industry formed an organization to represent professional fraud investigators. They formed the International Association of Credit Card Investigators (IACCI), which evolved into the International Association of Financial Crimes Investigators (IAFCI).

IAFCI is an international, nonprofit organization focusing on the financial crimes industry, especially as it applies to complex ORC financial crimes and fraud. It provides investigative resources and an environment in which the exchange of information concerning fraud investigations, prevention, and training can be collected and distributed for the good of its members.

I became an IAFCI member when I first started conducting fraud investigations in 1992. It was and still is the single best resource to network and gather investigative information to build any fraud case. I can’t imagine how you can successfully conduct a complex fraud inquiry without the IAFCI network infrastructure as a resource. I require membership for any member on my team. IAFCI gives its members the means to effectively communicate in a secure environment to promote the exchange of information in the never-ending effort to apprehend and prosecute financial crime law breakers.

IAFCI expansion mirrors the payment systems industry’s usage and acceptance throughout the world. Local and regional chapters have and are being formed across the world. Members come together from all segments of the financial community, law enforcement, and retail establishments. Our one goal is to stamp out financial fraud. Member benefits are listed on the right.

Investigative Support

- Online global directory with access to over 5,500 financial industry and law enforcement members

- Access to the Visa and MasterCard BIN directory

- Access to the Federal Reserve E-Payment Routing Directory

- Development of listings of state and federal laws pertaining to financial fraud

- Ability to post intelligence and requests on a 24/7 secure website and with CrimeDex

- Links to investigative resources websites

Intelligence

- Access to intelligence reports, fraud trends, reports on new technologies, and industry tips on a 24/7 basis

- IAFCI newsletter highlighting industry and government initiatives and key case activities

- Worldwide networking capabilities with investigation peers within the financial crime industry

- Partnership with the National White Collar Crime Center (NW3C) to coordinate their efforts in support of public and private sector financial crime and fraud investigators

- Employment opportunities

Training

- Regularly scheduled regional chapter intelligence meetings with forty chapters worldwide

- Annual international training conference

- Ongoing regional training seminars

- Training webinars

- Certification programs

- Legislative

- Provides a unified voice and resource on financial investigative issues

- Supports research and expertise regarding financial fraud

Special Offer: IAFCI is offering two-for-one membership discounts for qualified investigations professionals. Go to IAFCI.org for details.

Special Offer: IAFCI is offering two-for-one membership discounts for qualified investigations professionals. Go to IAFCI.org for details.