In the last edition of LP Magazine, we presented the findings from our first benchmark study, which focused on comparing practices and policies on managing shoplifting in retailing. This topic was chosen primarily because it had been discussed extensively at a recent practitioner meeting and was deemed a good starter topic for initiating this series of benchmarks. It also enabled us to gauge the degree of support we were likely to receive from industry leaders. After all, there is no point in starting a benchmarking series if there is no support or interest from those it is aimed to benefit.

As was outlined in the previous article and in the free benchmark report, the response rate was very good, soliciting feedback from companies representing 40 percent of the total US market, with a combined retail estate of more than 92,000 stores and annual retail sales of more than $1.3 trillion. Given this high level of support for this first benchmark study, it was agreed that we needed to develop a method to decide on what topics should be the focus of future benchmark surveys. It seemed sensible that the only way to do this was to reach out to the LP community and ask them what they would like to see covered next.

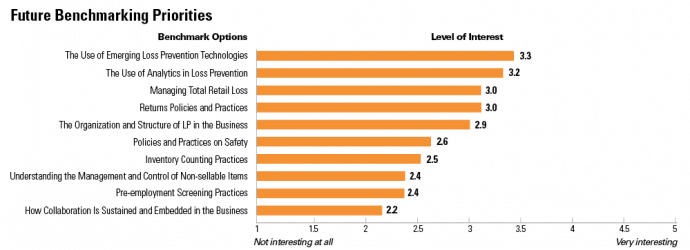

After an extensive brainstorming exercise and consultation with a number of LP representatives, we developed a list of ten possible topics that could be the focus of future benchmark studies, which are detailed below. We then developed a very short online questionnaire to find out from LP practitioners what their priorities would be based upon these ten topics, asking them to rank each of them based on their level of interest in the topic, using a five-point Likert scale.

The questionnaire was sent out to the 58 LP executives who had been approached for the first benchmark study on shoplifting policies and practices. In addition to scoring each of the possible topics, respondents were also given the option to add suggestions for subjects not covered by the ten topic areas offered. Those receiving the survey request were given a relatively short period of time to offer their opinions (one week), and in total 22 responded (a response rate of 38 percent).

No information was collected about the respondents, and so it is not possible to undertake any analysis by size or type of retailer. The survey was kept purposefully very short to encourage a quick response to enable the next benchmark study to be identified as quickly as possible.

What the Industry Wants to Know

As can be seen in Figure 1, the ten topics have been ranked in terms of the average score they received, where 5 equates to “very interesting” and 1 equates to “not interesting at all.” The overall score across all topics was 2.8, which suggests that there was a good degree of interest across all the ideas put forward for consideration. The topic receiving the highest level of interest was The Use of Emerging Loss Prevention Technologies, which scored 3.3 out of 5. The aim of this proposed benchmark study is to understand what new types of technology are currently being used and/or whether plans are in place to undertake a trial in the near future. It also plans to look at how existing technologies, such as EAS and CCTV systems, are being used in different ways.

It is perhaps easy to understand why this topic came out on top—the world of retail is changing fast with new technologies emerging at an increasingly rapid rate. Understanding what to invest in, in terms of new LP technologies is difficult, so it is easy to understand why it would be considered of real value to LP practitioners to understand more fully what their peers are investing in now and what they are planning to trial in the near future. This topic was closely followed by The Use of Analytics in Loss Prevention, which scored 3.2 out of 5. Closely aligned with the first topic on emerging technologies, the LP industry has seen a dramatic increase in the volume and range of data now available to their businesses. As one LP practitioner described it recently. “We now have a ‘data lake’ in the company, and the challenge is understanding how to navigate it in the best way to help the business the most.” He could have also added that it’s not just about navigating the “data lake” but also working out what to do with the information you have “fished” out of it. The second proposed benchmark survey will therefore focus on understanding how companies are using data analytics to better manage the problem of retail losses—what systems are in place, what skill sets are required, and how information is utilized and shared.

Two other topics received a score of 3 out of 5: Managing Total Retail Loss and Returns Policies and Practices. The former builds upon the recent report published by the Retail Industry Leaders Association’s Asset Protection Leaders Council and would consider how retail companies are going about defining and measuring losses in their businesses and what impact different categories of loss are having. The latter topic would focus on understanding the scale and nature of all types of product returns to retail businesses and charting the various policies and practices used and how these are balanced against other company priorities.

At the other end of the scale—suggested topics on how collaboration is sustained and embedded in the business, current practices on pre-employment screening, and developing a better understanding of the management and control of non-sellable items—all received a score of less than 2.5 out of 5 indicating they do have some interest but not as much as the topics listed earlier.

Some respondents did offer suggestions for other benchmark topics, including comparing LP salaries across functions and responsibilities; methods being adopted to manage mobile point-of-sale technologies; the impact and control of e-commerce; and the identification and effective management of high-risk stores. These topics will be included in lists of topics put forward for consideration in the future. We would also welcome more suggestions for possible benchmark surveys. Please feel free to get in touch with your ideas.

The Next Benchmark Survey: The Use of Emerging LP Technologies

We will now begin preparing the questions for this next survey and aim to have the results ready for the next edition of LP Magazine. We are very keen to broaden the range of companies taking part in these benchmark surveys. The more respondents we have, the better the sample will represent US retailing. It will also enable us to carry out more detailed analysis of the data, particularly by type of retail category, which was not possible with our previous study.

If you would like to help with the next study as a respondent company, please get in touch at one of the email addresses in the authors’ bio, and we will add you to our circulation list.