“So, what do you do?”

This is common question that for some loss prevention professionals presents a perplexing set of thoughts. “How do I adequately satisfy the inquirer’s request, without overcomplicating the dialogue?”

At a retail event, the response “loss prevention” is sufficient, or maybe “asset protection,” depending on the retailer. At a dinner party, one might give the short answer, but at a loss prevention industry function, the long answer may be more appropriate. Additionally, our families, spouses, friends, and colleagues sometimes appear tongue-tied when they have to know how to define loss prevention on our behalf.

Outside of LP, when someone is asked the what-do-you-do question, the general assumption is the answer, often short, is self-explanatory. “I am a PR manager.” “I work in HR.” “I am a doctor.” Simple question, simple answer. After a few more obligatory follow-up questions, the conversation moves on with a generalized understanding of what you do.

I recently did an informal survey on this question. I asked employees at various levels in the loss prevention industry how they answer the question. Here are some of the interesting answers:

“operations department in retail”

“retail investigations”

“operational auditor and investigator”

“corporate investigations”

“product protection specialist”

“investigations part of retail finance”

“investigations executive”

“loss reduction expert”

When I asked the question, there was about a 50/50 chance I would hear the words “loss prevention” or “asset protection” in the answer. The contradiction is this—if we all don’t use consistent terms to describe ourselves, then how can we expect others to understand our careers? Equally paradoxical is that for a group as passionate about employee awareness and training as we are, we remain divided on educating others about what we do. Noteworthy to me, the term “asset protection” seemed to produce more pride, usage, and less explanation than “loss prevention.”

Google the term “loss prevention,” and in less than a second you will likely get results 1-10 of about 10 million. For the record, LP Magazine made the first ten of most variations of loss prevention searches I tried.

A consistent role definition that transcends industries will increase shareholder and investor understanding of our impact on the bottom line. If investors view companies with strong asset protection or loss prevention programs as more secure and better monitored, with enhanced checks and balances, then we increase the business value.

Transcending Industries

Twenty years ago, if you compared the terms information technology (IT), loss prevention (LP), and asset protection (AP), odds are that LP was a more popular term. In 1989, IT was relatively unknown outside the technology crowd. At that same time, asset protection was a new term, while LP was a growing trend in retail.

Today, IT is ubiquitous in all industries, with exponential growth starting in the 1990s. Chief information officer (CIO) is a regular role at the executive level. While LP and AP have grown significantly since 1989, that growth doesn’t parallel IT. Today, C-level LP executives are rare, and even the vice president and director roles exist only in progressive, larger organizations.

It might be argued that IT is a basic function in all industries and reflects the growth of computers and the information age. Thus my comparisons may seem unrealistic, overly ambitious, or even delusional. Some might say the loss prevention industry can’t be compared to IT, HR, or marketing because they transcend all industries and businesses.

They do—but so do we. The dialogue changes when you say “security.” Every organization, industry, and business has to factor in security. Whether it is physical security, system security, data security, daily security, supply-chain security, executive security, personal security…the list is endless.

The dialogue also changes when you say “safety,” “investigations,” “auditing,” “risk management,” or “crisis management.” Suddenly, the debate regarding ubiquity and value isn’t so unreasonable; these areas transcend all industries and represent critical business areas. The irony is, asset protection and loss prevention are broader, more strategic umbrella terms, but significantly less used or understood outside of retail.

Universal Business Terms

Why aren’t asset protection and loss prevention universal business terms like human resources, information technology, marketing, and finance? There are several reasons:

- The broader terms asset protection and loss prevention are industry specific. If you have never worked in retail or wholesale, the terms are likely foreign. If you have worked in retail, you may know one but not the other.

- The universal terms everyone understands are narrow in defining our role. For example, security executive, investigator, auditor, crisis manager, and risk manager all describe parts of a significantly bigger picture.

- The terms have ambiguous and inconsistent definitions among organizations. Some organizations see LP and AP as strategic, profit-enhancing departments driving operational excellence, investigative expertise, asset control and reducing enterprise risks and losses, and ensuring a safe and secure environment—while others still see the cops-and-robbers role. Some don’t even have the role.

- We don’t have a singular term to describe what it is that we do in the loss prevention industry, and the fact that we alternate between loss prevention, asset protection, and security is problematic. Many industries have multiple terms, such as MIS vs. IS vs. IT and employee relations vs. personnel vs. HR. However, they naturally arrive at one consistent, universal business term.

- The terms are popping up in other industries. For example, the hospitality industry is starting to build loss prevention departments; Hyatt, Hilton, and Starwood Hotels all use the term. In banking, manufacturing, transportation, and production, our role exists, but the universal connector term is missing. In HR, marketing, finance, PR, facilities, and IT, while the industry and business may be different, and the roles are modified to meet the unique business, the universal connector term is constant.

As another example, most banks have security, loss control, asset control, and auditing departments. In many ways, these departments mirror our initiatives—asset controls and protections, operational controls and auditing, risk and loss mitigation, crisis management, investigative expertise, brand protection, and risk management. The challenge is that these groups are more fragmented with no universal connector term. However, in these same industries, HR, IT, PR, and finance are consistent connector terms.

Why Should We Care How to Define Loss Prevention?

This is more than an esoteric argument. There are substantive reasons for our industry to consider this question.

Shareholder and Owner Value. A consistent role definition that transcends industries will increase shareholder and investor understanding of our impact on the bottom line. If investors view companies with strong asset protection or loss prevention programs as more secure and better monitored, with enhanced checks and balances, then we increase the business value.

Transcend Beyond Retail. Once we demonstrate that our strategies, initiatives, and competencies go beyond just retail, then other industries will better understand and define the role. Today other industries maintain “security” as the overarching category because they misunderstand the broader implications of our terms. We value security as they do. However, we also see a comprehensive asset protection and loss prevention program as inclusive of security, plus much more.

Human Resource Planning. Once our role is seen as transferable between industries and businesses, our collective opportunities for growth increase. Today, if you are an unemployed former LP employee, getting non-retail industries to understand your potential value can be challenging. Tomorrow it will be like transferring from manufacturing IT to retail IT.

Student Interest. Sadly, loss prevention and asset protection generate minimal organic interest among the 15-25 age groups. Generally, people fall into our business by accident. Many of us have participated in college recruitment seminars, presentations, or internship programs that generate great interest from young people. The lesson here is that the more they know and understand about what we do, the more likely they are to want to do it.

A Business Topography of the Loss Prevention Industry

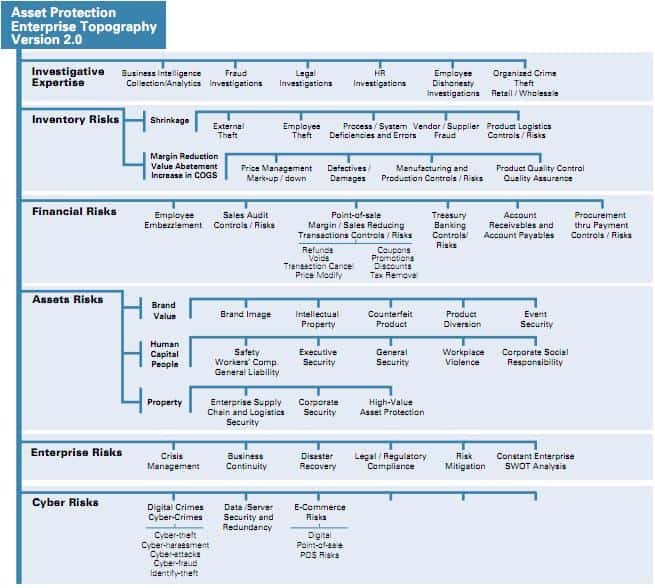

Based on industry information, previous documents, peer feedback, and discussions, an outline description of the business of asset protection and loss prevention is shown in Figure 1. This business topography identifies our critical lines of business impact and maps the corresponding subcategories.

The primary intent is to define how asset protection and loss prevention enhance businesses, provide key checks and balances, and reduce risks while increasing investor value. The secondary intent is to challenge other industries to view our model, better understand the value added, and merge it to their lines of business.

This is not a finished document, but hopefully the start of a dialogue to develop the final version or versions. It is designed to be a generalized outline. It will never be perfect, nor is it static; it will change with leaders, industries, and businesses. We are not the first industry to develop this approach. The accounting and consulting firm Deloitte has one for “human capital,” and many exist in IT, marketing, PR, and supply chain. Adrian Beck of the University of Leicester drafted a version years ago to broaden the definition of loss prevention as it relates to product and cash loss (see “Redefining Inventory Shrinkage—Four New Buckets of Loss” For a more recent attempt at defining loss, check out this article on the typology of total retail loss.).

The key to these documents aren’t the differences, but rather the constants. The constants create universal connector terms, making it easy for an investor, an entrepreneur, a CEO, an employee, an employer, or a student to understand the loss prevention industry and its value to a business.

This isn’t a document for copyright or sale, but rather a universal educational tool about our business. The final version should be owned by academic institutions, industry organizations, and industry publications as a comprehensive model of our roles and our impact on businesses and their investors.

We urge you to take up this debate within your own organization and with your peers across the industry. We also invite you to provide feedback and recommend improvements through this magazine portal.

The Bottom Line

In retail, we learned years ago that impaired assets like defective product, lost product, and damaged product don’t have the same value as normal assets or products. We either mark it out of stock (MOS) if missing, list it as an unknown loss (shrinkage), or mark it to sell (markdown). Either way, you take the hit and fix the problem.

Maybe if bankers and Wall Street executives had asset protection departments monitoring their inventory, those collateralized debt obligations (CDO) wouldn’t have all gotten AAA and BBB ratings. Maybe someone would have said, “We inventoried these mortgage-backed securities and some are impaired assets. We need to mark them accordingly and develop an action plan to ensure it doesn’t happen again.”

At a moment in history when investor confidence was somewhat low, executive integrity was in question, and poor checks and balances led to insecurity and a recession, our stock went up. Value is a universal connector. All businesses, investors, and shareholders want increased value.

So, do you know how to define loss prevention? Here is the bottom line: asset protection and loss prevention organizations deliver value. All businesses, investors, and shareholders want to grow and protect their assets while reducing their losses, risks, and liabilities in a safe and secure environment. That is what we do.

“I am in the asset protection and loss prevention business. Thanks for asking, and what do you do?”

This article was originally published in 2009 and was updated June 18, 2018.