“What is the single most important measure of the success or failure of your company’s loss prevention efforts?”

If you were to ask senior retail executives this question, the answer you would likely hear is, “Our shrinkage results.” This would not be surprising, as shrinkage affects profitability, shareholder return, resource allocation decisions, and more.

Therefore, it is reasonable to examine how companies measure this important metric, how often they measure it, and whether this number can be predicted and tracked. This post summarizes the results of a benchmark survey that focused on the frequency and type of inventory control methods.

The purpose of this survey was to catalog retailers’ physical inventory management processes as they relate to the frequency of inventory counting and whether counts are conducted using proprietary personnel or through use of an outside agency. Although the survey was conducted in 2007, retailers still find the results useful today.

The survey involved fifteen US-based organizations comprised of eight hard-lines specialty retailers and seven soft-lines specialty retailers. The companies ranged in store count from 350 locations to over 4,000 locations and represented over $132 billion in annual sales in the aggregate. No mass merchandisers, department stores, or grocery chains were in the sample group.

The survey was conducted by interviewing senior-level loss prevention executives in each organization. This allowed for discussion and elaboration that provided detail and insight into several of the questions.

Following are the questions asked of each organization, the responses they gave, any rationale they gave for their approach, and some commentary on the results from an outside perspective. Results in the tables have been broken down by hard-line versus soft-line retailers to explore whether different operating formats beget different inventory counting processes.

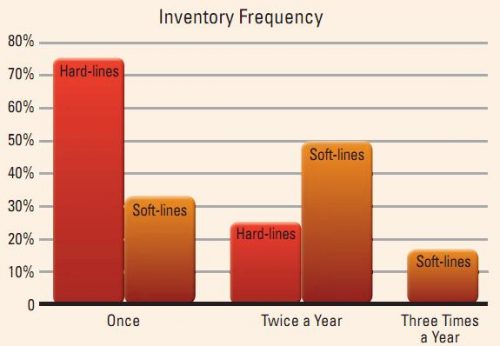

Q1: How often do you conduct physical inventory in each location during your fiscal year?

This question simply seeks to answer how often, as a general rule, physical inventory counting is done in each location throughout the year. It is notable that hard-lines retailers overwhelmingly depend on one count per year, whereas soft-lines retailers conduct physical inventory, on average, twice a year. However, this disparity may be somewhat balanced by the different approaches each segment takes towards interim inventory counts (see Q4).

Q2: Are any groups of subset stores counted more frequently?

Whereas the first question sought out the general rule for any one location, this question was to determine if there were processes in place to count certain stores more often. Overwhelmingly, both hard-lines and soft-lines retailers used second counts as a means for following up to initial inventory results. The rationale most often cited by the participants was to conduct follow-up inventory counts in their “target” or high-shrink locations.

“If a store’s inventory is off by a pre-determined percentage, it is recounted,” was a comment reflective of most respondents. As for the actual selection of stores to be recounted, one of the largest retailers surveyed explained that the subset store selection was a cooperative effort between existing inventory control methods, store operations, and loss prevention.

Q3: Do you conduct “wave” or “snapshot” inventory counts?

Originally, this question asked if participants were using cycle inventories or snapshot inventories. The term “snapshot” referred to the common practice of taking physical inventory counts in all stores at approximately the same time. This is often done near the end of the fiscal year, such as January or June.

The term cycle inventories was meant to reflect the practice of taking the physical inventory count of the store all at one time, but splitting the total stores up so that a certain percentage of the stores were conducted in each “cycle.” Some retailers use this method and take several cycles of counts throughout the year. However, the terminology was changed to refer to this methodology as wave inventories, to allow for the practice of true cycle counts.

True cycle counts involve the practice of counting inventory throughout the year in a store by counting certain sections on periodic basis. Theoretically, this could completely eliminate the need for an inventory control method where the entire store is counted at one time. The survey did not find anyone who is doing this as the primary means of inventory reconciliation at this time, but this is not an uncommon practice in distribution and warehouse environments.

According to the above terms, nearly 90 percent of the respondents conduct their inventory using a snapshot method as their primary approach. The few retailers that use a wave method determine their waves by spreading the number of stores counted each month on a proportional basis, which essentially means counting one-twelfth of their stores each month. One retailer actually conducts wave inventories throughout the year and then does a snapshot inventory at year-end.

Benefits of Snapshot Inventories

- Ability to synchronize shrink results for entire chain for purposes of performance appraisals, bonus payouts, target-store selection, and other operational programs

- Clear apples-to-apples comparisons from year to year without timing issues

- Allows entire company to treat physical inventory counts as an “event” where there is greater attention to store preparation, training sessions, and management attention

- Ease of inventory cut-offs for receiving, shipping, markdowns, and promotional events, which allows for cleaner inventory management

Benefits of Wave Inventories

- Ongoing measurement of shrinkage performance to allow for adjustments to financial accruals throughout the year, meaning no “surprise” at year-end

- Regular reporting of results keeps management’s attention on the issue of shrinkage as opposed to it being a once-a-year concern

- Ability to adjust inventory program schedule to accomplish various goals. For instance, higher shrinkage stores can be taken earlier in the year to get a worst-case scenario

- Greater management coverage and supervision of inventories, since a district manager can attend each location’s inventory, which is impossible to do if all stores are being counted at roughly the same time; and/li>

- Lower average inventory service costs since rates are higher during peak counting periods, such as January or June

Q4: Do you have an interim count process in place?

Across all respondents, over half of them do not conduct interim inventories. However, there is great variance when looking at the results by segment. Hard-lines retailers are much more likely to have an interim counting process in place. This may partially explain why soft-lines retailers are more likely to take multiple inventories in each location (see Q1).

The other factor that may be operating here is the “fashion” orientation of many soft-lines retailers. While hard-lines retailers generally have many items that are on a replenishment schedule from their warehouse, many soft-lines and apparel retailers are “flow-through” operations, where an entire seasonal fashion line might be shipped to stores and when it is gone, there is no replenishment; the merchants have moved on to another fashion look or season.

Therefore, there is not much demand from a merchandise replenishment or buyer perspective to get updated inventory counts on that merchandise. However, a hard-lines retailer may find this information critical, not only from a shrinkage perspective, but, as importantly, for the ability to have accurate perpetual inventory counts for replenishment and promotional purposes. This may be one of the operational drivers for the segment variance seen in these responses.

Q5: Do your interim adjustments correlate to your shrink?

Of those respondents who indicated they conduct interim inventories, they were asked if their interim inventory adjustments correlate to shrink. Overwhelmingly, the group indicated that they do correlate to shrinkage, although no effort was made to identify how that relationship was defined in their organization.

Q6: Do you use an outside agency to conduct your inventory counts?

The respondents were asked if they employ an outside agency to conduct their inventories. Nearly 90 percent of the respondents outsource their physical inventory process. The majority of retailers who outsource the physical inventory process employ one national agency. Four companies that outsource their physical inventory management also have an internal system in place. For example, one company conducts inventory internally in stores with poor inventory results. The stores with good inventory in the previous count outsource the process. Another large retailer has outsourced the inventory process for a number of years; however, they are piloting an internal physical inventory process.

Only two companies relied solely on conducting their inventory internally. They rent scanning equipment from vendors.

Q7: Have you changed your physical inventory control methods in the last two years?

As a primary operational function, physical inventory control methods are critical to the performance of retailers. The survey gathered information from the respondents on changes in the inventory processes within their company over the previous two years.

Nearly 60 percent of the surveyed companies changed their inventory process in the past two years. The respondents who indicated their inventory control methods have changed were then asked three follow-up questions regarding the changes. The results are detailed in Table 1.

Most respondents reported that the changes are working, except for the two retailers who changed their inventory cycle counts. Those two retailers indicated the change in cycle counts is making the inventory process more difficult.

Commentary and Conclusions

The goals of the original survey were to identify common inventory control methods and practices as a benchmark for participants to use in evaluating their own programs. The most significant finding in looking at the results is what it says about the current state of metrics and data in the retail loss prevention world. It is clear that most companies still only have one or two measurements for shrinkage per year.

The implications of this finding are important. In any business, it is difficult to manage performance and results without frequent, reliable measures of outcomes. It would be nearly impossible to imagine a retail organization that measured sales performance, cash flow metrics, personnel turnover or any other important business driver only a few times a year.

Therefore, it stands out that most retailers settled for infrequent measures of shrinkage, even with access to information systems and distributed databases. The reasons for this state of affairs are most likely reflective of challenges in developing more frequent measures, as opposed to resistance on the part of executives. Identifying these challenges was not part of the scope of this survey project, but would be a worthy topic to investigate in future research.

This post was originally written in 2008 and was updated October 23, 2017.