We are all familiar with use of the word “shrinkage” to describe the losses experienced by retailers, although it is impossible to find any industry-wide agreement on what it actually means or the types of losses that are typically included when it is used by different retailers.

For some, it only refers to the difference in value between expected and actual stock levels, calculated through periodic inventory counting exercises (in effect losses where the cause is unknown).

For others, it can be a much more inclusive bucket with a range of recorded losses being included, such as product markdowns, damages, and spoilage, and a range of process-related failures, such as pricing and product set-up errors.

In this respect, comparing rates of shrinkage between different retailers can be a tricky business—differences may be more a consequence of differences in definition rather than an indicator of loss management proficiency.

Where the shrinkage calculation is based exclusively upon differences in expected and actual stock levels (the most common definition used in the UK grocery sector), whether the resulting metric properly captures the true impact of a merchandise retailer’s losses is highly questionable.

Recent work focused on developing a definition and typology of total retail loss, an attempt to better understand how retailers experience a wider range of losses in their businesses, has begun to shed light on the true scale of the problem.

But there could also be a range of additional costs associated with particular types of products that could also undermine their profitability, many of which can be hidden within the overall business model, making it difficult to surmise whether a given product or category actually generates a profit.

Background

It is within this context that the current research is presented. The ECR Community Shrinkage and On-shelf Availability Group had become aware of growing concerns about the losses relating to the sale of grocery store magazines and newspapers in the UK—a category not normally associated with high levels of loss. It was decided to undertake a study to better understand the nature and extent of the problem—the key drivers of this loss.

The 2016 study, undertaken by the University of Leicester, was fortunate to receive the active support of five of the largest UK grocers, representing nearly 72 percent of the market, that were prepared to share their data relating to a wide range of losses and additional costs associated with newspapers and magazines (N&M).

Rather than just analyzing the shrinkage number from each of the participating retailers, the study sought to capture a broader basket of losses and costs.

The N&M category is perhaps unique in generating a range of additional losses and costs that are not typically associated with many other product categories that grocers typically stock and that are driven by a combination of product-handling complexity and the process requirements of the wholesalers and publishers providing the stock.

These unique factors include:

- unresolved delivery losses

- unresolved returns losses

- carriage charges

- extra staffing costs associated with dealing with a unique set of process challenges (For instance, publishers set strict requirements for when and how unsold stock must be returned by the retailer, and failure leads to a loss of credit.)

In this respect, the study offered a unique opportunity to go beyond just the shrinkage number and delve much deeper into how retailers can be impacted by a broader range of losses and costs not typically combined into one analysis.

Shrinkage Results for Grocery Store Magazines and Newspapers

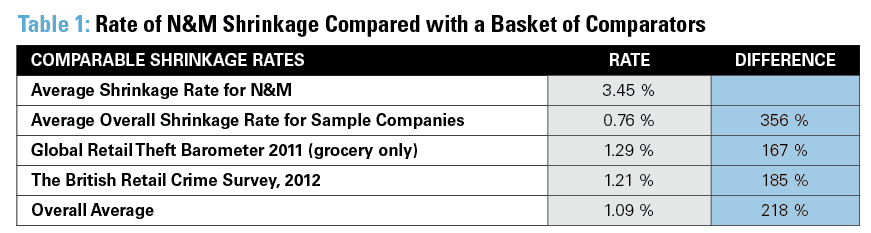

It is interesting first of all to look at how the recorded shrinkage rate for the N&M category compares with the overall rate for the participating companies and to compare that with some published industry numbers (Table 1).

As can be seen, the recorded rate of shrinkage for the UK grocery store magazines and newspapers category (3.45 percent) is considerably higher than the overall average rate of shrinkage for the companies taking part in this study—some 356 percent higher. Even when estimates of shrinkage are used from two well-known surveys of shrinkage covering the UK, the recorded rate for N&M is still considerably higher.

The rate of shrinkage for grocery captured by the Global Retail Theft Barometer in 2011 (considered the most reliable of the recent surveys undertaken using the Global Retail Theft Barometer name) was 1.29 percent, and the 2012 British Retail Consortium overall rate of shrinkage was 1.21 percent. If an average is taken of the three benchmark shrinkage numbers, which suggests that overall shrinkage might be 1.09 percent of sales, the N&M figure is still 218 percent higher.

It seems clear that the grocery store magazine and newspaper category has a profoundly high rate of shrinkage. To put this in even sharper contrast, the N&M category makes up 0.85 percent of overall sales but accounts for 3.86 percent of the overall shrinkage costs of grocers. Overall, the projected N&M shrinkage loss for the UK grocery sector is estimated to be £52 million (~ $67 million) a year. Finally, if the N&M category recorded a rate of shrinkage on a par with the other products stocked by retailers, it would bring the overall average rate of shrinkage down by 7 percent.

Detailed in Table 2 is a breakdown of the various losses and costs associated with the N&M category. Each of the five retailers taking part in this study were able to provide an overall shrinkage figure for the N&M category and how much of that number was made up of unresolved delivery and returns losses, the carriage costs charged by the two main wholesalers, and the additional staffing costs associated with the unique N&M process. This data was then used to estimate the costs for the total UK grocery sector—calculating the costs and losses as both a percentage of total N&M sales and total value.

As can be seen, overall shrinkage accounts for the largest proportion of loss at 3.45 percent, with estimates suggesting that unresolved deliveries and returns could amount to 44 percent of this type of loss with other forms of shrinkage, such as theft and damage, making up the remainder of the shrinkage losses. The second highest area of cost was perhaps not unexpected—staffing—which accounts for an estimated 3.17 percent of N&M sales, amounting to nearly £48 million (~ $62 million) a year. The third and final area of cost that has been identified as part of this research was carriage costs—the charges made by the wholesalers to deliver and return product minus any credits for the insertion of supplements by the retailers. This amounts to nearly £16 million (~ $21 million) a year for the UK grocery sector, or 1.03 percent of N&M sales.

Taken together, these costs and losses come to a staggering £115.4 million a year (~ $150 million), equivalent to 7.65 percent of the N&M grocery market. In many respects, this is an underestimate of the total costs associated with this category—a charge incurred by some companies that employ third-party companies to manage this process has not been included due to issues of confidentiality.

It was possible to provide a limited breakdown of the staffing costs associated with handling N&M, although no two retailers used the same categories of activities. Overall, the delivery and returns processes accounted for approximately 56 percent of staff time, with deliveries absorbing the most time.

It is also worth noting that 30.3 percent of all stock delivered to retailers appears to be returned to the wholesalers, amounting to £457.3 million (~$594 million) for the UK grocery sector as a whole. The returns rate varied considerably between newspapers and magazines: the calculated rate for newspapers was 21.7 percent, while for magazines it was 40 percent.

This seems an extraordinary amount of stock to be returning, especially in light of growing concerns around the environmental impact of big business and the need to develop sustainable models of operation that minimize carbon emissions. It also undoubtedly explains some of the high costs associated with managing this category and potentially raises questions about the accuracy of “sales” and “circulation” figures regularly published by the industry given the relatively high rate of unresolved returns claims that would appear to be included in these figures.

Conclusion and Next Steps for the Industry

This short review of the UK grocery store magazines and newspapers category has shone a light on an area experiencing high levels of loss and associated costs. In terms of shrinkage alone, it is a category generating significantly high rates of loss—typically 356 percent higher than the average rate of shrinkage for all the other product categories stocked by UK grocers. This is further compounded by additional costs relating to extra staffing and carriage costs, adding a further 4.2 percent as a percentage of sales, adding up to a bill of £115 million (~$149 million) a year. This relatively high rate of loss would seem to be due, in part at least, to a uniquely complex and demanding process, caused in some respect by the nature of the product—highly time sensitive—but also by industry requirements that appear at first sight to be overly bureaucratic and rather outmoded in 21st-century retailing.

What this study also highlights is that any reduction in losses and costs associated with retailing the N&M category will require the development of a collaborative approach engaging retailers, wholesalers, and publishers. To this end, the ECR Community Shrinkage and On-shelf Availability Group has established a News and Magazines Shrink and OSA Group in the UK, with a specific focus on developing a series of interventions to try and address the issues outlined in this article. The group is made up of retailers, wholesalers, distributors, and publishers seeking to answer the following specific questions:

- Would including the “on” and “off” sale date in the product barcode help store staff to better manage the process of delivery and returns?

- Would changing the length of the newspaper returns window, currently a Tuesday, to a later day in the week reduce missed returns, especially the weekend newspapers?

- Would the addition of a plastic wrap to bundles of grocery store magazines reduce consumer complaints, the volume of returns, and total supply chain costs?

- Would it be better for the shopper and more efficient for the industry if the supplements for newspapers were inserted before they arrived at the store?

- Would a new receiving process, leveraging the work-process models used by other direct-to-store vendors, be more efficient and offer a lower-cost model for the industry?

This study has been extremely illuminating because it graphically reinforces the importance of understanding all the losses and associated additional costs of retailing certain types of merchandise. Only by bringing them all together is it possible to make a more informed decision about the veracity of any given business model.

It also shows that sometimes the solution to retail problems can best be found through adopting a collaborative approach, focused upon unearthing the root causes rather than the apparent symptoms. Sometimes you really do have to move beyond the headline and get to the meat of the story.

This article was originally published in LP Magazine Europe in 2016 and was updated January 28, 2019.