At a recent ECR Community Shrinkage and On-shelf Availability Group meeting in Milan, Martin Speed from River Island delivered an insightful presentation on how the company uses a range of indices to understand which of its stores are most likely to experience an increase in shrinkage in the future.

It reminded me of the critical importance of recognizing that all forms of retail risk are not homogeneously spread across the business.

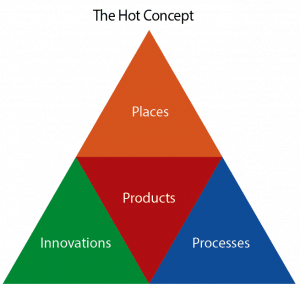

Particular places, products, processes, and increasingly, certain retail innovations are much more vulnerable to loss than others. Identifying these “hot” elements in the business can be a powerful way to enable increasingly busy loss prevention managers, operating in ever more-complex environments, to focus upon the vital few rather than the trivial many.

Within the ECR Group, this idea has been defined in the past as the Hot Concept—a simple way for retail organizations to begin prioritizing what they do with their loss prevention resources when it comes to managing various types of losses.

The Hot Concept: Hot Places

The non-random distribution of risk has been the subject of considerable empirical study, albeit it primarily focused upon non-business-related crime—we are all now relatively well briefed on particular places in urban areas where the risk of becoming a victim of crime is likely to be elevated, especially at night. For instance, one US study has shown that just 3 percent of the geographic area of one city accounted for 50 percent of all recorded crime.

Within retailing, many companies now have some form of risk register for their physical stores, ranking them on a number of different factors such as shrinkage history, levels of recorded crime in the surrounding area, number of incidents of violence, and so on. This is then often used as a way to prioritize security spend, bring store management attention to their relative position in the ranking, and direct the activities of the loss prevention team. How well these rankings actually reflect the distribution of risk is more of a moot point.

Martin Speed’s presentation highlighted the broad range of variables that may be correlated with higher levels of loss, including factors beyond what might be regarded as traditional crime indicators, such as length of store management vacancies, percentage of transactions voided, and age of the store.

Of course, hot places can also exist within particular locations. Certain parts of retail stores can be more vulnerable to loss than others, such as hard-to-observe areas where shop thieves find it easier to hide stolen items or back-room areas where products are more likely to be stolen or damaged, such as the unloading bay. Overall, it seems that many in the retail loss prevention community are now becoming relatively well attuned to understanding how risk can vary by place and to use this information to inform their activities.

Hot Products

Equally, considerable research has been undertaken on trying to understand which retail products are more likely to be “hot” in terms of their likelihood to be stolen. Ron Clarke’s seminal work on stolen goods identified the key aspects that he thought made particular types of items far more susceptible to theft than others. He developed the acronym CRAVED to describe the key attributes:

- Concealable (easy to hide when being stolen)

- Removable (easy to remove)

- Available (easily accessible)

- Valuable (either personally to the thief or to others who may wish to purchase it)

- Enjoyable (generally the product is enjoyable to own or consume)

- Disposable (a ready market for the stolen item exists)

While the CRAVED acronym has stood the test of time relatively well and certainly resonates clearly with retailers, it does lack a degree of practical applicability: it is often difficult for loss prevention practitioners to develop strategies to counter some of the characteristics present within CRAVED.

For example, it is sometimes difficult to derive from this approach how to reduce the value of a product without losing profitability or how to make something less enjoyable without reducing sales, although new approaches are being developed to try and address these issues.

Where there is typically much less focus is identifying products that are highly prone to non-malicious forms of loss, although back in 2009 I did make an attempt to generate my own hot product acronym to highlight the potential characteristics of these types of products-SERV. This stood for:

- Sensitivity to time (products that have finite sell-by dates such as fresh fruit and meat)

- Expectations of consumers (products that will not be sellable if they are damaged in any way, such as high-value boxed spirits, electronic goods, and memorabilia)

- Reprocessed product (products that are re-worked in the retail environment, such as raw food materials, or where they are repackaged, such as meats that are butchered in the store)

- Vulnerability of packaging or product (items that are highly vulnerable to damage as they move through the supply chain, such as eggs and products sold in cartons)

While nothing like as elegant as Clarke’s acronym, SERV was an attempt to broaden the loss agenda to begin to think about hot products beyond those items that were likely to be stolen. Certainly, within the world of grocery, non-malicious forms of loss, such as food going out of date, is usually much more financially impactful than malicious losses generated by theft.

In the future, it would be interesting to see loss surveys that begin to differentiate hot products based upon root cause-products most prone not only to theft but also to other drivers of loss, such as being damaged or going out of date. This would generate much more informative and powerful benchmarks for the participating retailers.

Hot Processes

While there is a considerable body of knowledge within the disciples of supply-chain management, operations management, and total quality management on understanding issues that can generate problems in retail supply chains, relatively little of this work typically gets transferred across to the world of loss prevention to help them understand what processes may be generating losses within their sphere of influence.

In order to help address this, the ECR Community developed the Loss Prevention Road Map, a structured approach offering retail practitioners a framework whereby they could begin to identify and analyze the retail processes that may be causing losses. For instance, reducing the problem of products being found to be damaged in a retail store is likely to require a better understanding of the points along the entire supply chain where the problem may have occurred-an approach that may well conclude that developing an effective and sustainable solution is as much the responsibility of the product manufacturer as it is the retailer. Work undertaken by the ECR Community found that there were five key forms of process that were particularly hot:

- Product movements (increases the risks of damage, delivery to wrong location, wrong quantity, incorrect paperwork, and so forth)

- Handling (damage, exposure to theft, loss of paperwork, and so forth)

- Change of form (reworking can cause loss of identification, damage, and wastage)

- Exchange of ownership (as well as the risks associated with physical movement, processes relating to the transfer of information and money can also pose risks that may generate loss and so forth)

- Storage (increasing the potential risk of damage, theft, loss of value, obsolescence, and so forth)

By using tools such as the Loss Prevention Road Map, practitioners can map the processes for any given product (such as particular hot products) and understand what risks and vulnerabilities are present in the supply-chain processes and then seek ameliorative actions to mitigate those that pose the greatest risks.

Hot Innovations

The final component of the Hot Concept relates to retail innovations. The pace of change within retailing continues to be breathtaking—new technologies, modes of shopping, and ways of paying are being continually introduced. While change and renewal are key components of retail success, they also bring new risks as well—new ways in which businesses can be exposed to loss. Understanding how and which retail innovations pose significant risks is challenging for loss prevention leaders. Often, they are introduced quickly and with little or sometimes no engagement with loss prevention teams, inevitably leading to insufficient knowledge and planning about how to manage any subsequent risks that emerge.

A good example of a hot innovation is the self-scan checkout technologies that are now increasingly being used across the world. It seems clear, certainly in the grocery sector, that this technology is now posing a considerable risk to increased levels of product theft. As levels of loss increase, responding to this evolving and increasingly important innovation is becoming a key priority for loss prevention executives.

Understanding the Value of the Hot Concept

All organizations have a finite amount of loss prevention resources, and this is likely to become even more acute as retail competition and complexity develops further. While in the past loss prevention managers have had to rely mainly upon common sense, personal hunches, and to a degree, retail mythologies to decide where to focus their attention, the growing availability of a wide range of increasingly fine-grained retail data points is enabling them to be much more considered in the approach that they now adopt.

For example, in the case presented by River Island at the recent ECR meeting, the process of identifying hot places is now using a plethora of data points, enabling the loss prevention team not only to be more accurate in their assessment of risk but also to develop the capability to be predictive and understand where future risks are likely to occur.

Moreover, as innovation continues at a pace and becomes ever more important to the success and indeed survival of retail businesses, identifying which developments are likely to pose the highest risk will be a key role of loss prevention leaders—as will helping the business to understand how these risks and their consequences need to be factored into future plans and financial projections. If the last 100 years of retail history has taught us anything, it is that few if any developments—be they new products, new ways of working, or indeed transformations in the shopper experience-come without a modicum of risk. Identifying and, where appropriate, managing those that generate the greatest risk should remain a cornerstone of the work of the loss prevention function.

This article was originally published in LP Magazine Europe in 2017 and was updated October 10, 2018.